●CBN Has Devalued Naira To N631 At I&E

The Central Bank of Nigeria (CBN) has devalued the Naira to N631 to the dollar from N461.6 it sold at the Importers and Exporters (I&E) window.

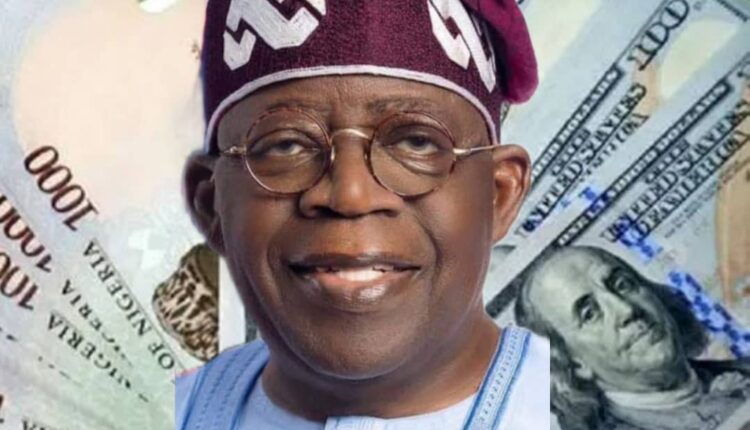

The devaluation came 48 hours after President Bola Ahmed Tinubu announced the plans of the federal government to unify the country’s exchange rate to stimulate the economy.

In his inaugural speech, minutes after he was inaugurated as the 16th president of the country, Tinubu said, “Monetary policy needs a thorough house cleaning. The Central Bank must work towards a unified exchange rate. This will direct funds away from arbitrage into meaningful investment in the plant, equipment and jobs that power the real economy.”

There has been a wide margin between the I&E window and the parallel market, a situation that experts say encouraged round-tripping with Bureau de Change operators.

On Tuesday, President Tinubu met with the top echelon of strategic institutions including the CBN Governor, Godwin Emefiele, at the presidential villa.

At the end of the meeting, neither the presidency nor Emefiele disclosed the outcome of the briefing. It was, however, gathered that the issue of the exchange rate was discussed at the meeting.

The situation has seen the CBN devise several measures to check the practice as well as completely stop the sale of forex to BDC.

Dollar to naira black market exchange rate today Apr 15, 2023 On Tuesday, President Tinubu met with the top echelon of strategic institutions including the CBN Governor, Godwin Emefiele, at the presidential villa.

At the end of the meeting, neither the presidency nor Emefiele disclosed the outcome of the briefing. It was, however, gathered that the issue of the exchange rate was discussed at the meeting.

The President also met with the Group Chief Executive Officer of the Nigerian National Petroleum Company Limited, Mele Kyari. The removal of petrol subsidy was discussed, it was gathered.

The report finding, however, revealed that at the resumption of the weekly bidding for foreign exchange, the apex bank sold the spot rate to banks on behalf of their customers at N631 to a dollar and most bidders got the full amount they requested. One of the customers told this paper that they applied and that their request was fully granted at N631 as against N461.6.

READ ALSO : FIRS: Nigeria’s Tax-To-GDP Ratio, 10.86% As At 2021

The move has also seen prices at the parallel market trend downwards. Checks by this paper revealed that prices dropped from N750 to a dollar in the early hours of yesterday to N745 by evening in Abuja and Kano respectively.

The naira weakened in the parallel market to the lowest level in a year on expectations of a possible change in exchange rate management after Tinubu takes office on Monday.

The naira dropped to N762 a dollar on Friday from 775 the previous day in the unauthorized market in Lagos, said Umar Salisu, a BDC operator who tracks the data in the nation’s commercial capital.

The unit has weakened steadily in the parallel market since last week after stabilizing for most of this year.

The market arbitrage (difference between the official and parallel markets) has widened in the past three years from N100 per dollar or about 30 per cent in 2020 to over N400 per dollar (above 100 per cent) sometime last year when the black market rate spiked to N880/$.

Development institutions, including the International Monetary Fund (IMF), are wary of exchange rate differential in excess of five per cent and warn that such could trigger unhealthy manipulation that could negatively affect other efforts on market stabilisation

From 2020 to 2022, the CBN spent about $42 billion intervening in the foreign exchange market to stabilise the naira. The amount was sold to the end-users, including students and tourists, at the official rates, which are way off the effective exchange rate of the naira.

READ ALSO : Muhammad Nami: Double Honour For The Nation’s Tax Czar

According to the Financial Stability Report, a publication of the CBN, the apex bank sold $9.2 billion in the market in the first half of last year.

The full data for the second half are not available, but the annualised value is assumed to have surpassed that, especially with the level of social and economic activities associated with the second half.

Whereas the black market rate averaged N730/$, the I&E window finished at suppressed N447/$ on average. That puts the arbitrage at N283/$, pushing the CBN’s FX subsidy in the year to about N3.65 trillion.

Realistic exchange rate regime to save N4tr – Ex-DG LCCI

In his analysis on the impact of FX subsidy, Dr Muda Yusuf, the Director of the Centre for Promotion of Private Enterprise (CPPE), said a realistic exchange rate regime would add N4 trillion to the federation account.

The former director general of the Lagos Chamber of Commerce and Industry (LCCI), said the exchange rate regime constitutes an enormous burden to the economy and public finance.

He said: “Nigeria is facing an all-time tight fiscal space. This year’s budget is stuffed with over 50 per cent deficit, even in the face of spurious revenue projections.

The federal government is contemplating an additional loan of N8.8 trillion to support funding of the budget, which could raise its outstanding liabilities to nearly N80 trillion.

Devaluation a double-edged sword – Expert

Basil Abia, a private research consultant with a track record of supporting think tanks, start-ups, and development projects in Nigeria, said the devaluation of the naira will result in increased inflation and an erosion of the Nigerian consumer’s already dwindling purchasing power.

However, he adds that there could be some benefits from the devaluation. “If it is perceived to be temporary, it may present attractive opportunities for foreign investors to invest in our domestic financial markets.

It is not certain, but it is a possibility that FPI (foreign portfolio investments) inflow to Nigeria may temporarily increase.”

2023 budget first casualty – Prof. Uwaleke On his part, a Professor of Capital Market, Uche Uwaleke said, “The first casualty will be the 2023 Appropriation Bill. It means the 2023 budget, which is predicated on N435 per dollar is dead on arrival.”

He said, no doubt, the devaluation will force down the volume of imports and reduce the pressure in the forex market temporarily. “But have we thought of the impact it would have on the pump price of fuel and the multiplier effects? How about the knock-on with regard to inflation and interest rates, especially at a time when the inflation rate remains elevated? Is high inflation rate not inimical to investments whether local or foreign?” he said.